We use cookies to offer you a better experience. For more information on how we use cookies you can read our Cookie and Privacy Policy.

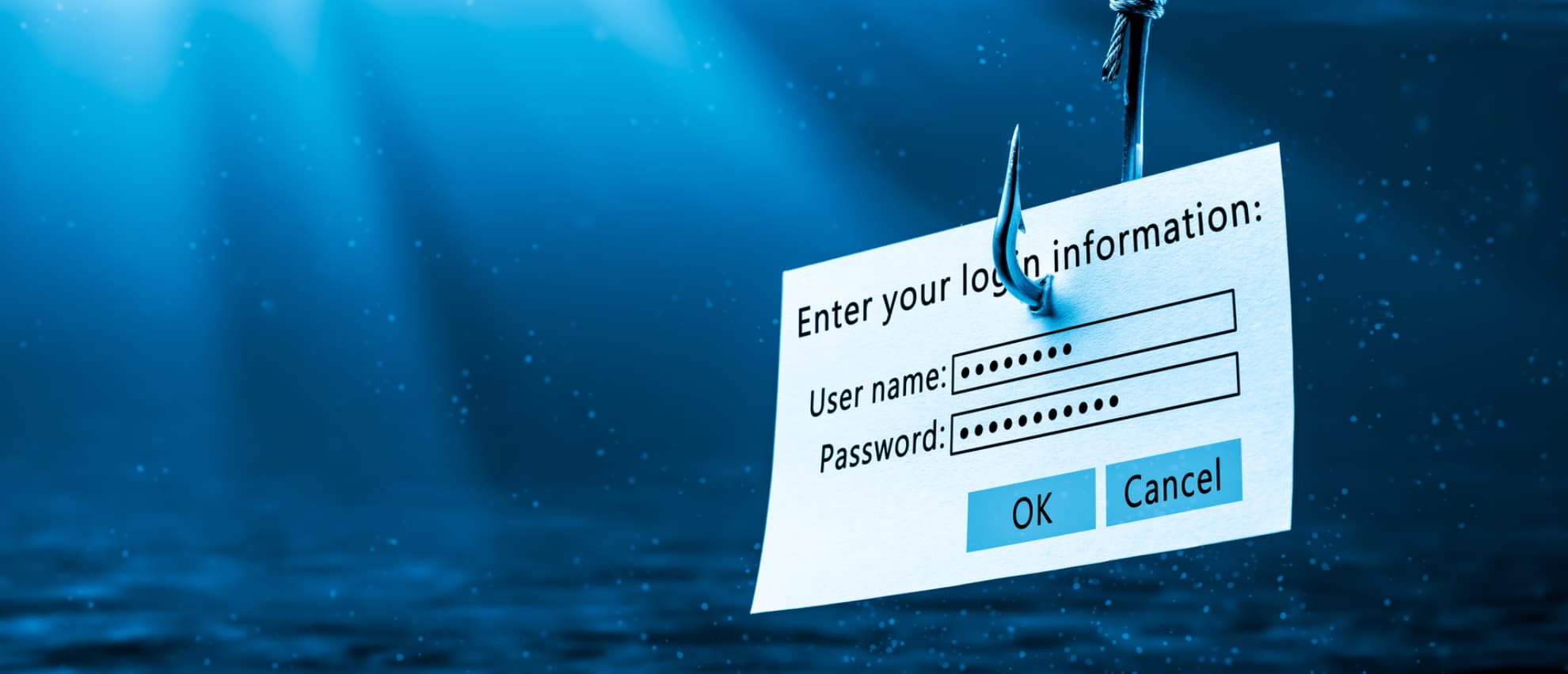

Smishing vs. Phishing vs. Vishing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

With advances in technology and online storefronts, it can be difficult to spot a scam before becoming victim. When it comes to cybersecurity and protecting your sensitive information online or over the phone, it’s important to know the latest tricks criminals use. Understanding the key differences between smishing, phishing, and vishing can save you from accidentally sharing sensitive information with scammers.

While each type of virtual attack attempts to steal personal information like bank statements and credit card numbers, they take different approaches. Phishing uses emails and links, smishing uses text messages or common messaging apps, and vishing uses voice calls and voicemails to obtain sensitive information.

Key Differences Between Smishing, Phishing, and Vishing

When it comes to phishing, smishing, and vishing, the foremost thing to remember is each attack could compromise your personal information. Scammers often use seemingly legitimate email addresses and phone numbers to gain trust and infiltrate your network, banking, and personal information.

The key differences boil down to how scammers obtain the information. Phishing is one of the most common forms of fraud, where scammers use a seemingly real email address with a link that urges you to input information like your full name, social security number, and credit card number.

Smishing uses text messages or common messaging apps, like Slack, to contact unsuspecting individuals. A link or website URL where scammers will ask for your personal and banking information is usually attached to the messages.

Like the previous two types of scams, vishing gains access to your personal information, but this method uses a phone call or voicemail to prompt users to expose private information.

Each type of scam could put your personal and banking information at risk, so understanding exactly how they work and who they target could save you significant time and money.

Here’s a closer look at phishing, smishing, and vishing and how you can protect yourself against these attacks.

SMISHING

According to a recent study, over 64% of the world’s population sends or receives a text message daily1. It’s an increasingly common form of communication that seems innocent and second nature, therefore, becoming an ideal avenue for scammers. Among the 23 billion daily text messages sent worldwide2, scammers imbed dangerous and unsuspecting links that could quickly lead to fraud.

Smishing is an increasingly popular form of virtual scamming where individuals pose as employees of common businesses or banks to gain the trust of their recipients. The definition of smishing can be summed up as a type of virtual scam that uses a targeted text message to convince the recipient to open a link that will capture personal information or install malicious software.

The scammer often takes measures to seem like they’re a well-known business, like using an official logo or a similar phone number, to gain the recipients’ trust. The prompting message may include your name and address, which can be found through an online search, but it makes the scam seem like an official message.

The message will typically include a time-sensitive prompt such as “Click the link today to avoid a late-fee,” which makes the recipient more likely to fall for the scam. Embedded links in these messages can lead to the installation of harmful software that compromises your phone’s security. With the embedded software, scammers can access private details such as emails, messages, phone logs, and even banking information.

Another way smishing compromises your information is with a prompt to open a specific URL webpage. The webpage may ask you to input sensitive information to confirm your identity, which the scammers will then have complete access to.

If you find yourself receiving an unexpected message from someone that poses as a bank, utility, or mortgage employee, always call your specific institution to verify that a message was sent on their behalf. It’s always best to double-check with the “company” that sent the message to ensure you’re not the target of a smishing scam.

PHISHING

Phishing was one of the first types of online scams to gain attention and traction. Although it’s been around for much longer and many people know about it, it’s still a common way for scammers to acquire sensitive information. Although the goal is the same, there is a key difference between smishing vs. phishing.

Phishing uses emails instead of text messages to trick recipients into providing personal information. Attackers often send out an email to dozens of recipients simultaneously, hoping someone will open the embedded link and provide sensitive information.

While an email blast like this is the most common form of phishing, there are cases of targeted attacks where the scammer will choose a specific recipient based on social or financial status. This type of attack usually includes a detailed message that seems like it’s meant specifically for you. It often urges you to click a time-sensitive link or visit a specific URL.

Once you click an embedded link or visit a dangerous URL, a prompt will likely encourage you to enter information such as your full name, social security number, bank account information, and more. This could lead to identity fraud and theft.

Another way scammers use phishing is by encouraging you to click on a link or URL through the email. Once you do either, the computer or smartphone could automatically download harmful software that allows scammers to access your personal information.

If you receive a suspicious email from an address you don’t recognize, do not open the email. If you open an email and realize you don’t know the sender or it seems suspicious, immediately delete it and avoid clicking on any pictures, links, or URLs.

A great way to prevent these attacks from happening to you is by utilizing services and software like HP Wolf Security. You can rest easy knowing that this security system works in the background while you handle your day-to-day tasks, emails, and messaging.

VISHING

Vishing is another dangerous scam that targets sensitive information from unsuspecting individuals. The key difference between vishing vs. phishing is that these attacks are often in the form of a phone call or voicemail and often encourage recipients to provide detailed information like their name, address, and credit card number.

Vishing can be best described as a type of cyber attack where scammers use phone calls and voicemail to obtain sensitive and personal information.

Scammers often use fake names or pose as an employee of well-known businesses or banks to gain your trust. They might ask you to confirm your identity by providing your birthday or social security number, which they will use to access personal accounts or information.

These scams are hard to identify since they often use blocked phone numbers and sound like official members of the company they are imitating. The voicemails often urge you to contact them immediately to avoid things like late fees and overdrafts or to avoid your account from getting shut down.

Once you answer or return the calls, scammers use carefully crafted scripts to trick you and acquire sensitive information. The best way to avoid a vishing scam is to ignore calls from unknown or blocked numbers. If a vishing scammer leaves a voicemail asking you to return the call, first call the official company or business they’re posing as to see if the call was legitimate.

SUMMARY

Phishing, smishing, and vishing are each dangerous scams that obtain sensitive information and often lead to identity fraud or theft. They’re increasingly popular and could lead to major personal and financial setbacks.

With such a large percentage of individuals utilizing emails, text messaging, and phone calls to conduct personal and professional business, it’s imperative to have a protection plan in place. Remember to always double-check with specific firms or companies if you receive a phone call, email, or text from someone claiming to be an employee.

A follow-up call can save you from a dangerous cyber attack and only takes a few minutes. After receiving any kind of suspicious messaging or phone calls, keep an eye on your bank statements for unusual activity. If you see any transactions you don’t recognize, immediately call your banking institution to resolve potentially fraudulent charges and avoid future fraud on the same account or card.

Although educating yourself on the warning signs and recognizing these attacks can save you from being scammed, the best way to avoid attacks is with proper hardware and software. HP is an industry leader in safe technology that incorporates security hardware in certain products and provides top-of-the-line security systems like SureView and HP Wolf Security.

Features such as privacy mode, two-factor authentication, and early detection software keep your phones and computers safe from potentially dangerous scams. HP is dedicated to providing users with safe products and experiences, and they’re backed by a team of cyber security experts.

Arming yourself with these products and security programs can prevent thousands of dollars in theft or even identity fraud, giving you one less thing to worry about.